Financial Ratios

After having knowledge of reading and intercepting financial statements, a logical next step would be to take a look at the different conclusions you can draw from a company's financials. For the most part, this work is done by calculating and comparing several different ratios.

Liquidity Ratios

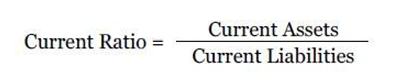

Liquidity ratios are used to determine how easily a company will be able to meet its short-term financial obligations. Generally speaking, with liquidity ratios, higher is better. The most frequently used liquidity ratio is known as the current ratio:

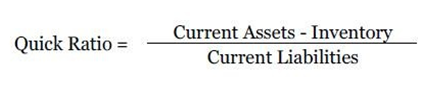

A company's current ratio serves to provide an assessment of the company's ability to pay off its current liabilities (liabilities due within a year or less) using its current assets (cash and assets likely to be converted to cash within a year or less). A company's quick ratio serves the same purpose as its current ratio: It seeks to assess the company's ability to pay off its current liabilities.

The difference between quick ratio and current ratio is that the calculation of quick ratio excludes inventory balances. This is done in order to provide a worstcase-scenario assessment: How well will the company be able to fulfill its current liabilities if sales are slow (that is, if inventories are not converted to cash)?

Profitability Ratios

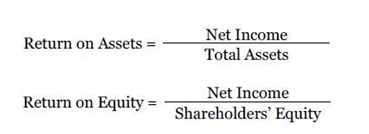

While a company's net income is certainly a valuable piece of information, it doesn't tell the whole story in terms of how profitable a company really is. For example, Google's net income is going to absolutely dwarf the net income of your favorite local Italian restaurant. But the two businesses are of such different sizes that the comparison is rather meaningless, right? That's why we use the two following ratios:

A company's return on assets shows us a company's profitability in comparison to the company's size (as measured by total assets). In other words, return on assets seeks to answer the question, "How efficiently is this company using its assets to generate profits?"

Return on equity is similar except that shareholders' equity is used in place of total assets. Return on equity asks, "How efficiently is this company using its investors' money to generate profits?"

By using return on assets or return on equity, you can actually make meaningful comparisons between the profitability of two companies, even if the companies are of drastically different sizes.

Financial Leverage Ratios

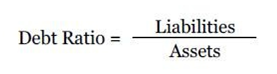

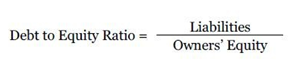

Financial leverage ratios attempt to show to what extent a company has used debt (as opposed to capital from investors) to finance its operations. A company's debt ratio shows what portion of a company's assets has been financed with debt.

A company's debt-to-equity ratio shows the ratio of financing via debt to financing via capital from investors.

Asset Turnover Ratios

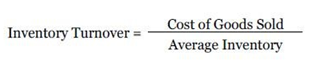

Asset turnover ratios seek to show how efficiently a company uses its assets. The two most commonly used turnover ratios are inventory turnover and accounts receivables turnover.

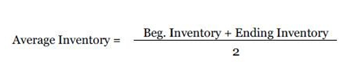

The calculation of inventory turnover shows how many times a company's inventory is sold and replaced over the course of a period. The "average inventory" part of the equation is the average Inventory balance over the period, calculated as follows:

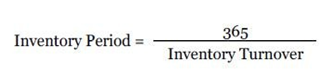

Inventory period shows how long, on average, inventory is on hand before it is sold.

A higher inventory turnover (and thus, a lower inventory period) shows that the company's inventory is selling quickly and is indicative that management is doing a good job of stocking products that are in demand.

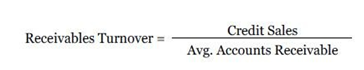

A company's receivables turnover (calculated as credit sales over a period divided by average Accounts Receivable over the period) shows how quickly the company is collecting upon its Accounts Receivable.

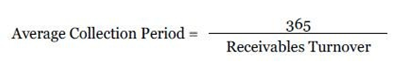

Average collection period is exactly what it sounds like: the average length of time that a receivable from a customer is outstanding prior to collection.

Obviously, higher receivables turnover and lower average collection period is generally the goal. If a company's average collection period steadily increases from one year to the next, it could be an indication that the company needs to address its policies in terms of when and to whom it extends credit when making a sale.