Liquidity Ratios

Liquidity Ratios shows a company's ability to pay off its debts as and when they become due. Simply put, this ratio explains how promptly a company can convert its current assets into cash so that their liabilities can be paid off on a timely basis. Generally, Liquidity and short-term solvency are used together.

Why Liquidity ratio?

Liquidity ratio plays an important role in the credibility as well as the credit rating of the company. If the company is regularly failing to repay it's short-term liability, this will lead to bankruptcy. Therefore this ratio is important for checking on the financial stability of any company and credit ratings.

Current Ratio

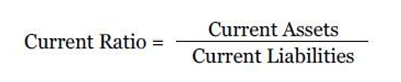

The most frequently used liquidity ratio is known as the current ratio. The formula to calculate the current ratio is:

A company's current ratio serves to provide an assessment of the company's ability to pay off its current liabilities (liabilities due within a year or less) using its current assets (cash and assets likely to be converted to cash within a year or less).

Quick Ratio

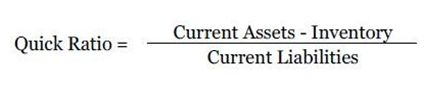

A company's quick ratio serves the same purpose as its current ratio. It seeks to assess the company's ability to pay off its current liabilities. The formula to calculate Quick Ratio is:

The difference between quick ratio and current ratio is that the calculation of quick ratio excludes inventory balances. This is done in order to provide a worstcase-scenario assessment: How well will the company be able to fulfill its current liabilities if sales are slow (that is, if inventories are not converted to cash)?